Why is Russia invading Ukraine?

On the 24th of February 2022, Russia invaded Ukraine. The reason why depends on who you ask.

According to Russian president Vladimir Putin, the current conflict is not a war, invasion, or occupation. It is a “special military operation” designed to:

- Depose the Ukrainian government to save the Ukrainian people / Russian ethnic minority from government-led bullying, oppression, and genocide

- Demilitarise and de-Nazify Ukraine

- Force the Ukrainian Government to implement the Minsk Package of Measures for peace in Eastern Ukraine, which they have otherwise refused to do.

To understand these claims, we need to understand some history between the two states.

In 1991 the Soviet Union collapsed. Russia and Ukraine, the 1st and 2nd largest ex-Soviet states respectively, became independent countries. Ukraine has since sought to establish its independence of Russia, namely by strengthening the Ukrainian language (over Russian), and by postering to join the North Atlantic Treaty Organisation (NATO) and European Union (EU). Russia, however, continues to cling to former Soviet values and quietly wishes for a return to a Soviet republic focused on itself. And for reasons I’ll explain shortly, it continues to view Ukraine and Russia as one people. Therefore, all attempts by Ukraine to distinguish itself from Russia and align itself with the West threatens Russia and ‘oppresses its people’.

“The collapse of the Soviet Union was the greatest geopolitical catastrophe of the century”

-Vladimir Putin, 2005

Russia and Ukraine “are practically, as I have said many times, one people.”

–Vladimir Putin, 2014

“Modern Ukraine was entirely created by Russia.”

–Vladimir Putin, 2022

In 2014, these conflicting ideologies led to the ‘Euromaiden protests’ and subsequent ‘Maiden Revolution’ in Ukraine, whereby the then-Ukrainian government was overthrown for its decision to not sign the European Union – Ukraine Association Agreement (a crucial step in joining the EU), with the view to instead join the competing Eurasian Economic Union (EAEU). Whilst on the surface the EAEU appears to be an economic union just like the EU, it is better described as a network of bilateral relations centred on Russia, designed to insubordinate ex-soviet states.

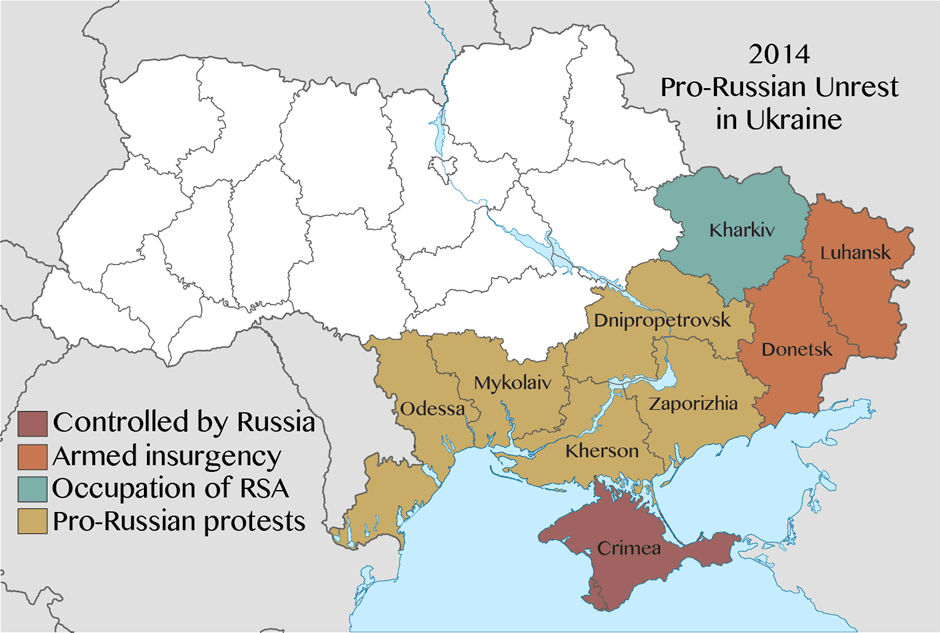

The protests leading to the ousting opposed what protestors saw as government corruption, abuse of power, and more broadly the violation of human rights in Ukraine. However, this was not a consensus across the state, with Eastern and Southern Ukraine experiencing its own pro-Russian protests. And maybe this should not come as a surprise, based on the data below:

| Russian Ethnic Minority in Ukraine | Percentage of Population | Location Type |

| Donestsk | 38.2% | Oblast/State |

| Luhansk | 39% | Oblast/State |

| Kharkiv | 25.5% | Oblast/State |

| Crimea | 58.3% | Autonomous Republic |

| Kyiv | 13.1% | Capital City |

| Sevastopol | 71.6% | City |

| Supporters of Eurasian Economic Union Integration (EAEU) | Supporters of European Union Integration (EU) |

| 43% | 32% |

This ultimately led to Russian-backed armed insurgencies in the regions of Luhansk and Donetsk together commonly called the Donbas, and the annexation of the Ukrainian Crimea.

In further defence of Russia’s claims, whilst Ukraine has enacted a few positive reforms since the protests of 2014, according to Freedom House, corruption remains endemic, and initiatives to combat it are only partially implemented. Attacks against journalists, civil society activists, and members of minority groups are frequent, and police responses are often inadequate. Furthermore, its military continues to support armed separatists in the eastern Donbas area in an attempt to retain control.

Fast forward to today’s conflict, you might be surprised to find yourself thinking “Wow, Russia has semi-reasonable motives. Why is no-one talking about this?” I was horrified to find myself thinking the same thing, and rewrote many paragraphs being more Russian-lite in the process.

However, my sympathies stop with what I have written above, which fails to capture the complete truth behind the Russian invasion.

The pro-democratic and anti-corruption sentiments that the 2014 conflict had awoken in Ukrainians has since brought about a rise in anti-Kremlin, and sometimes openly anti-Russian sentiments. Take a look at the updated table from earlier.

| Supporters of Eurasian Economic Union Integration (EAEU) | Supporters of European Union Integration (EU) |

| 17% | 59% |

Although I have no statistics to support this opinion, I would also argue that these statistics have swung more in EU favour in recent years, along with even fewer identifying as ethnic Russians than indicated by the 2001 census (2023 census incoming – stay posted). This is the basis for which we should assess the modern conflict. As soon as you do, you realise how difficult it is for Russia to justify today’s occupation, and to continue to deny Ukraine’s sovereignty. That is, it is becoming increasingly difficult for Russia to claim the Ukrainian people as their own.

Regarding claims of genocide and other governmental mistreatment, it is important to note that in previous and current conflicts, both sides are guilty of human rights and Geneva Convention violations. Without sharing the details here, which you are welcome to research yourself, this includes the violent mistreatment of prisoners by the Ukrainian military, and on the other side attacks on civilians and medical facilities by the Russian military (with the latter being arguably worse). Additionally, Non-Government Organisations (NGO’s) and journalists alike have continued to assert that no systematic killing has occurred in the conflicted areas at the hands of Ukrainian or Ukrainian-backed military since the conflict broke out in 2014.

The idea that Ukraine must demilitarise, and may attempt to arm itself with nuclear weapons, is an entirely self-serving half-truth born from Russia’s desire to consolidate power across Europe. Ukraine poses absolutely no threat of its own towards Russia – Russian President Vladimir Putin simply cannot tolerate Ukraine’s aspirations to build a democracy and sees demilitarisation of Ukraine as the only way it can continue to influence or control the country. It is worth noting that Ukraine willingly surrendered and/or destroyed its post-soviet arsenal of military weapons back in 1993. Russia, on the other hand, ironically placed its own nuclear arsenal on “special alert” a mere week into its invasion of Ukraine and has fulfilled minority views in the 1990’s that a denuclearized Ukraine would be subject to Russian aggression. Because of recent aggression, the re-nuclearization of Ukraine for self-defence continues to be a hot topic in the Ukrainian political sphere.

The accusations that the Ukrainian government is “pro-Nazi” is since, during the conflict in Donbas, Ukraine’s armed forces included volunteers from battalions accused of harbouring neo-Nazi ideology. However, to extend this to a comment on the treatment of Ukrainian (“Russian”) citizens is propaganda at best and is laughable coming from the openly authoritarian Russian regime.

Finally, Putin’s claims that Ukrainian authorities have ignored and sabotaged the implementation of the Minsk Package of Measures for a peaceful settlement of the crisis beginning in 2014, is again a half truth. In reality, neither side has met the Minsk agreements of 2014 and 2015 to establish peace in Eastern Ukraine. Namely, Ukraine refuses to carry out elections in Donbas or surrender the area to a “special status”. However, Ukraine has refused since Russia will not remove its armed groups from the area to ensure a fair election. A classic catch-22.

A summary of developments since the fighting started

- Russia has and continues to distribute misinformation about the war through its state-controlled media. For example, surrounding;

- Ukrainian military genocide and targeting of civilians in Donbas

- Russian public support for the war.

- Russia claim it has received threats from United States-funded biolaboratories in Ukraine – an unsettling lie which may be used as a precursor to its own future chemical warfare.

- A myriad of sanctions and economic restrictions have been placed on Russia by countries around the world, as well as by the EU and NATO generally. These sanctions vary accordingly. However, to oversimplify these sanctions, they include:

- The banning of (certain) Russian banks from the SWIFT network – a high security financial messaging system for facilitating payments among 11,000 financial institutions in 200 countries, making it extremely difficult for Russia to participate in international financial markets.

- Germany halting certification of the Nord Stream 2 gas pipeline – a 1,230-kilometer pipeline intended to transport large amounts of natural gas directly from Russia to Europe via Germany.

- The freezing or seizure of Russian assets outside of Russia

- The limit or prohibition of exports to Russia, including technology exports in an attempt to limit Russia’s ability to advance its military and aerospace sector.

- The limiting of access to foreign currency reserves held outside of Russia.

- Limits or bans on Russian state-affiliated media to combat Russian disinformation and propaganda

- Preventing state-owned companies from operating or generating profit outside of Russia, mainly focused on financials and energy sector.

- An increase in tariffs or outright ban on imports of Russian products.

- The closing of domestic airspaces to Russian flights.

- Whilst the Russian Ruble initially fell 30% against the U.S. dollar at the start of the conflict, the value of the currency has rebounded and has been largely preserved by:

- The inflow of foreign currency as European countries continue to buy Russian gas out of dependence.

- The foreign countries allowing Russia to access its foreign currency reserves to meet sovereign debt repayments

- Russia telling certain buyers of Russian natural gas that they must pay their natural gas bill in Rubles (unconfirmed).

- The Russian Central Bank limiting the trade of foreign currencies by the Russian public.

- The (more than) doubling of Russian interest rates to 20%

- Russia closed its own stock exchange (tracked by the MOEX Russia Index) starting the day of the invasion (Feb 28th) until it reopened in a limited capacity on March 24th. It has since fully reopened.

- Russia has avoided default on its international bond payments three times in the last month, making repayments of $117m, $447m, and $2.2b to bondholders. Russia is permitted to make these repayments in Rubles.

- The European Union (for the first time in history) as well as individual countries have been and continue to provide lethal aid shipments to Ukraine, in addition to humanitarian aid. Putin considers these shipments non-legal participants in the conflict, and therefore “not protected by international law.” Putin has also cautioned against and threatened the West for its indirect participation in the conflict so far.

- The Ukrainian military, albeit with the support of numerous countries and unions, has repelled the Russian invasion with surprising effectiveness. Equally, the Russian military has appeared surprisingly inept in certain conflicts. Several senior Russian military officers have reportedly been killed.

- Ukraine has defended against Russia’s attempts to encircle and take control of capital city Kyiv, from which Russia has now withdrawn. Russia has instead redoubled efforts to control outskirt regions.

- There are reports that some members of the Russian military are sabotaging their own equipment – a glimpse into the rouse of public support for the war. Putin has reportedly fired several generals and arrested intelligence officers in an internal purge.

- Russia has and continues to carry out attacks on civilian targets, and a case is being built against them by the International Criminal Court.

- Ukraine has been accused of violently mistreating Russian prisoners

- Belarus has taken part in the war on Russia’s side despite denials by the Belarusian president.

- Russia continues to report implausibly low numbers of killed or wounded as a result of the conflict to save face.

- Over 500 private companies have withdrawn or limited operations in Russia to various extents, including countless big names. To even list a few would be an egregious understatement, so I encourage you to research this yourself.

- Global oil and gas prices continued to skyrocket despite Western efforts to avoid sanctioning Russia’s energy sector, as Russia is one of the worlds largest exporters (particularly to other European countries).

- Peace talks have been occurring since the first few days into the conflict but have either failed to yield anything, have been violated by Russia, or have included entirely self-serving concessions. Putin has not demonstrated any willingness to de-escalate with Ukraine or the international community, nor has he provided reasonable demands that would lay the groundwork for de-escalation or negotiations.

- Putin has asked for military and economic support from China, which has not been provided. However, China does not condemn the “special military operation” and routinely amplifies Russian disinformation about the conflict. Additionally, it blames the U.S. and NATO for causing this conflict by pushing “Russia to the wall.”

- As part of sanctions on Russian oil, the U.S. and other countries have released record amounts of their emergency oil reserves to battle rising fuel prices. The U.S.’s most recent release will more than cover its ban on Russian oil for at least the next 6 months.

What this means for investors and buying opportunities

A quick look back through history will tell you that the effect of geopolitical instability on share markets is short term. In fact, in almost all cases, share market indexes almost always recover completely (and even gain) within a few months – as was the case during the comparable Russian Spring in 2014.

I am confident that the current Russian occupation of Ukraine is no different. Therefore, the correct (albeit boring) answer to your investing woes is to stay the course and continue to invest long term.

But let’s dig a little deeper. What does the Russian invasion mean long term and where are the buying opportunities?

The main global impact of note comes from the fact that Russia is the world’s 2nd largest exporter of crude and refined petroleum, and the 4th largest exporter of petroleum gas. Within this statistic is the fact that nearly 50% of Europe’s energy comes from Russia. I won’t agonise over oil shortages, of which industry and consumers alike are already painfully aware. However, the energy discussion is more interesting. At first, I was convinced that this conflict meant nothing for the long-term energy reliance of Europe on Russian energy. However, as the conflict has continued, I’m not so sure. The European Union is now considering a massive and expensive redesign of its whole energy grid to completely exclude Russian natural gas, and member countries have redoubled efforts to develop sustainable renewable energy sources. Therefore, non-Russian European energy companies stand to benefit greatly – not only from short term increases in the price of oil and natural gas, but also from long-term structural shifts.

Oil stocks and ETF’s to watch:

- United States Oil Fund (NYSE: USO)

- United States Brent Oil Fund (NYSE: BNO)

- United States 12 Month Oil Fund (NYSE: USL)

- Invesco DB Oil Fund (NYSE: DBO)

- BetaShares Crude Oil Index ETF-Currency Hedged, Synthetic (ASX: OOO)

- BHP Biliton Limited (ASX: BHP)

- Woodside Petroleum Limited (ASX: WPL)

Energy ETF’s to watch:

- Invesco Dynamic Energy Exploration & Production ETF (NYSE: PXE)

- Vanguard Energy ETF (NYSE: VDE)

- Fidelity MSCI Energy Index ETF (NYSE: FENY)

- The Energy Select Sector SPDR Fund (NYSE: XLE)

- iShares U.S. Energy ETF (NYSE: IYE)

- BetaShares Global Energy Companies ETF (ASX: FUEL)

Another area that investors are looking is defence stocks. However, whilst I do not consider myself a particularly ethical investor, I have always despised that defence stocks are the first to rise when war is on the horizon. Of course, it makes perfect sense, I’m just personally uninterested.

Aerospace and Defence ETF’s to watch:

- iShares U.S. Aerospace & Defense ETF (NYSE: ITA)

- SPDR S&P Aerospace & Defense ETF (NYSE: XAR)

- ARK Space Exploration & Innovation ETF (NYSE: ARKX)

- SPDR S&P Kensho Future Security ETF (NYSE: FITE)

With how high inflation is currently and based on guidance from the U.S. Federal Reserve and Australian Reserve Bank, we can expect monetary policy to tighten and interest rates to continue to rise over the short to medium term. We can expect to see this benefit the financial sector and the economies where it is most prevalent (Australia the UK, I’m looking at you). Therefore, the ASX200 and FTSE100 may be worth a glance, not to mention the built-in diversification benefits of investing in an index.

Wheat and agriculture stocks. In 2020, Russia was the worlds biggest exporter of wheat, with total exports valued at $10.1b that year. Whilst agriculture stocks took longer to respond to the conflict than oil and energy companies, the change is now definitely here with companies such as Archer-Daniels-Midland Company (NYSE: ADM), an American wheat producer, posting gains of 15.87% since the start of the conflict, as the world looks for alternatives to the Russian supply. There may even be an opportunity for Australia to take advantage of the shortage and subsequent price hike, with Australia’s total wheat exports representing around 15% of the world wheat trade annually.

Agriculture and Wheat Stocks and ETF’s to watch:

- Teucrium Wheat Fund (NYSE: WEAT)

- Tecrium Agriculture Fund (NYSE: TAGS)

- The VanEck Agribusiness ETF (NYSE: MOO)

- BetaShares Global Agriculture Companies (NYSE: FOOD)

- Archer-Daniels-Midland Company (NYSE: ADM)

- GrainCorp Ltd (ASX: GNC)

Gold is one of Russia’s top exports and the price of gold has shot up (and subsequently come back to earth) since the start the conflict. Calendar year to date, the price of gold rose as much as 12.49%, but has since fallen to become relatively flat. The old barons of Wall Street continue to view gold as a haven during times of instability. And it’s true more in the sense that it is a self-fulfilling prophecy as opposed to the fact that it retains value significantly more than alternative investments (although there is some of that too). My gut-reaction to beware has largely been proven correct as the price of gold ETF’s return to normal pre-conflict levels. However, this conflict may be different for the long-term prosperity of gold-related companies and ETFs in that gold is directly affected by the conflict, being Russia’s largest precious metal export.

Gold ETF’s to watch:

- The SPDR Gold Shares (NYSE: GLD)

- iShares Gold Trust (NYSE: IAU)

- SPDR Gold MiniShares Trust (NYSE: GLDM)

- GraniteShares Gold Trust (NYSE: BAR)

- ETF Securities GOLD ETF (ASX: GOLD)

- Betashares Gold Bullion ETF – Currency Hedged (ASX: QAU)

- VanEck Vectors Gold Miners ETF (ASX: GDX)

Outside of gold, which has taken occupied the headlines more than usual due to its export relationship with Russia, there are two other minerals that should be in focus – palladium, used primarily in electronics, and diamonds, used primarily in jewellery. Russia accounts for around 45% of total global production of palladium, and prices are up around 65% since mid-December 2021. By a decent margin, the next biggest exporters of palladium are the United States, the United Kingdom, and South Africa. In terms of home brewed palladium companies, Zimplats Holdings Ltd (ASX: ZIM) might be worth a look, although it is up 18.83% already calendar year to date. When talking Russian diamonds, Indian diamond giant Alrosa enters the conversation. Alrosa is the world’s largest diamond mining company, accounting for approximately 30% of world diamond output, and is 1/3 owned by the Russian government. Approximately 90% of Russian diamonds are either exported to be resold by India/Alrosa as rough diamonds, or (in most cases) exported by India/Alrosa after being cut and polished. So, should we be expecting a diamond shortage? Well… no. It should be business as usual. This is because, under current sanctions, a diamond can be mined by an Alrosa subsidiary (in Russia), polished or cut in India or another country, and sold to another country without any restriction. Given the Russian government’s 1/3 shareholding in Alrosa, I find this loophole unlikely to be closed, and the diamond appetite of the world unlikely to be diminished. Therefore, outside of gold, our focus should include platinum group metals (which includes palladium).

Mineral ETF’s to watch:

- Physical Palladium Shares ETF (NYSE: PALL)

- Sprott Physical Platinum & Palladium Trust (NYSE: SPPP)

- Physical Precious Metals Basket Shares (NYSE: GLTR)

- ETFS Physical Platinum (ASX: ETPMPT)

- ETFS Physical Palladium (ASX: EPTMPD)

- ETFS Physical Precious Metal Basket (ASX: ETPMPM)

Russia is also the world’s biggest exporter of semi-finished iron. Semi-finished iron stocks are to wheat stocks, what wheat stocks were to oil and energy stocks – back of mind. Prices have not shifted as much, however the buying opportunities may be no less pronounced. It may be worth looking at alternative semi-finished iron companies located in companies such as Brazil / Japan / India, and even Ukraine, notwithstanding the impact this invasion will have on their production capacity in the medium term. For example, Ukraine’s largest steelmaker Metinvest announced mere weeks before the Russian invasion that it would invest $1b in the modernisation of existing facilities and building of new production facilities this year. It is worth noting that current sanctions include a ban on imports of iron and steel from Russia. However, the impact on share prices and buying opportunities are likely moderated by the fact that 3 of Russia’s 4 largest semi-finished iron trade partners have so far refused to place economic sanctions on Russia, including China, Turkey, and Mexico.

Steel ETF to watch:

- VanEck Vectors Steel ETF (NYSE: SLX)

There are two ways of thinking when it comes to emerging markets. On one hand, they may see strengthened trade relations with Russia as they have been hesitant to impart economic sanctions. Some emerging market economies may even be able to sure up the shortfall in global supply created by sanctions on Russia, be it India with diamonds or Brazil with semi-finished iron, or South Africa with palladium. China as well, will continue to provide cars and vehicle parts to Russia, its biggest import, with those trade relations stronger than ever. On the other hand – the firmer hand – many emerging market countries are oil importers. This includes China, Taiwan, Korea and India, which combine to make up 72% of the MSCI Emerging Markets Index. The high price of oil, combined with high levels of inflation globally, will cause issues for emerging market economies as they spend a greater share of their income on food and energy. This would explain the approximate 12.7% decline in my preferred emerging markets ETF, year to date (ASX: IEM).

Finally, cyber security. The Russia-Ukraine war started as a physical conflict as much as it did a digital one, with Russia planting bugs to steal, modify, and most notably to destroy Ukrainian data long before they breached Ukrainian physical borders. This has drawn the attention of myself, and many investors, to cyber security investments. From a broader perspective, cyber security concerns are nothing new. There has been a general rise in the protecting personal data and cloud computing for years now, and the global cybersecurity market is expected to grow to $1.75T by 2025 at a Compound Annual Growth Rate (CAGR) of 15%. Governments are also starting to take notice. For example, the Australian Government in its most recent budget announced a staggering $9.9 billion investment for cyber security over ten years. Therefore, it might be worth looking at BetaShares Global Cybersecurity ETF (ASX: HACK), which holds a significant stake in the attractive Palo Alto Networks (PANW). As an added bonus, this ETF is only up 1.78% YTD. You could also consider a stake in the comparatively cheaper Global X Cybersecurity ETF (NDQ: BUG). From a narrower perspective, the thing which brought me to research cyber security in the first place was thoughts on the rise of VPNs in view of internet-based companies fleeing Russia (yes, my Gen-Z brain was thinking about Instagram). With this in mind, it may be worth looking at a stake in Kape Technologies, which recently acquired one of two largest and most respected VPN providers in the world in Express VPN (the other being Nord VPN, not publicly listed). Kape’s share price has slid recently despite strong fundamentals but earnings growth remains well above industry averages (LON: KAPE).

Closing comments

I think it’s important to note that I have not, and could not possibly through this medium, cover everything in relation to the current Russia/Ukraine conflict. As much as I would love to, it is simply not possible for me to cover every element of their history, every alarmist comment by Putin, every sanction, or every sector impacted by the crisis. My views are a reductionist summary designed to sort through the noise which has filled the news feeds for the past 2 months. That being said, I have some final comments.

Russia’s actions in Ukraine are undoubtably an unjustified invasion of a sovereign country. It has once again brough to light Russia’s desire to return to a consolidated soviet-like power to oppose the economic and military power of the modern West. My feelings about the extent to which Russia should be held accountable are moderated purely by the knowledge that there are countless Russian civilians who oppose this occupation, and they should not have to suffer.

Russia has a vested interest in controlling the narrative of the conflict and will continue to utilise state-controlled media to justify the continuation and escalation of the conflict. All justifications will continue to be half-truths and propaganda, concealing an unprovoked war of aggression. The goal line for the occupation will continue to be moved, and the true impact of sanctions on the country domestically will continue to be hidden, so that Putin may continue to claim success or victory. The rise of anti-Russian sentiment is real, and we should not pretend it is not, but this should not come without a recognition of where it has come from and where it should be directed.

While many companies will resume trade with Russia once the conflict is over, and several sanctions will be lifted, I believe we are seeing a structural change in relationship Russia has with the rest of the world. A change which may see them being an isolated North Korea-like body whilst the developed world leaves them behind. It is certainly possible for the world to ‘make do’ without strong trade relations with Russia, however the short-term transition will be painful, particularly for power-hungry Europe.

Generally speaking, higher oil and energy prices remain front and centre in conversations surrounding the impact of the war. It will continue to drive inflation and ultimately hurt economic growth by forcing the diversion of resources to the dirty essentials. To borrow a passage that is not mine…

“ (higher oil and energy prices) will eat away at consumer budgets and corporate balance sheets while tossing a wet blanket over the economy”

-Unknown

Whilst there have undoubtedly been consequences for investors, these are transitory only, and most investors should already have seen a marked improvement in their portfolio performance since the beginning of the conflict. Remember, it is not the war itself which has caused stock market losses, it is uncertainty – and uncertainty will continue to evaporate. In terms of identifying investable opportunities moving forward, my personal preference at this point would be to purchase the stocks and indexes which have been beat down by this conflict and are yet to improve, as you will not find profits chasing gold or oil companies which have already surged in value.

Based on how peace talks have proceeded so far, I cannot see a resolution to the conflict that does not (at least) involve Russia’s firm control of the Donbas region. I do not think other countries will extend their involvement in the war beyond continued lethal and humanitarian aid, as putting troops on the ground would be an insane and unnecessary escalation.

And hey, if I’m wrong, none of which will be around much longer to point it out.

So informative! wonderful first post 🙂

Thank you so much, Adam.